E-commerce Conversion Rate(CR) and What are the Factors That Effects To CR

What is conversion rate?

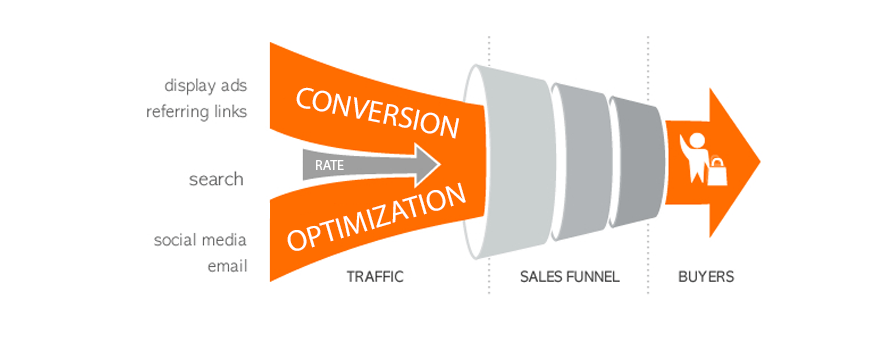

Conversion rate ( CR ) is defined as the number of people who come to your e-commerce website and “convert” by taking whatever desired action you  want for them to take. This could be folks who came to your site and signed up for your email newsletter, downloaded a piece of content or even those who came and ended up buying from your store. Whatever is it you’d like for your visitors to do, this is what you want to measure.

want for them to take. This could be folks who came to your site and signed up for your email newsletter, downloaded a piece of content or even those who came and ended up buying from your store. Whatever is it you’d like for your visitors to do, this is what you want to measure.

Within this post, we’re going to focus on turning shoppers into buyers once they arrive to your store.

Why is conversion rate so important?

Your store’s conversion rate is important for the mere reason that it is the metric by which you measure your business profitability. You can use the conversion rate to predict future success or use it to determine that something isn’t working. Then, you can use the conversion rate as a measuring stick as you attempt to fix the customer experience on your website.

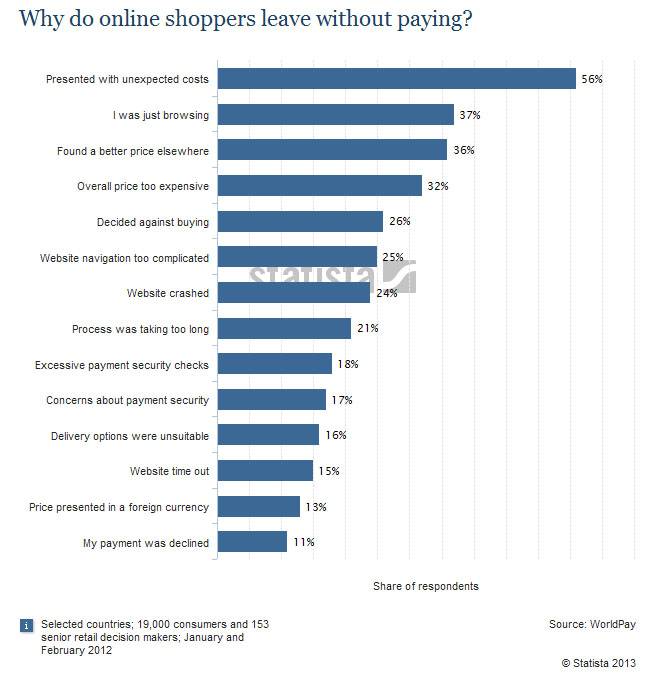

What effects to the conversion rate ?

From WPP:

We learned how global markets compare when it comes to the number of shoppers making decisions in store. In some cases, results were not far off the much quoted 70% figure, but in other cases findings were very different. Shopper behaviour varies depending on shopper profile, the category they are in, the channel they are shopping, the product they are buying, and where they are in the world.

NORTH AMERICA – 72%

In North America, on average, 72% of shoppers make at least one decision in-store. However that can vary widely by market, with Dallas shoppers at 39% v those in Boston, where 90% make at least one purchase decision while they are shopping.

Display drives category

The effect of displays was clearly apparent. One word of caution though. Brilliant in-store displays can certainly benefit a particular brand, but the bigger benefit can sometimes go to the retailer. Sales in a category with displays often will rise, even though sales of the brand on display may not necessarily enjoy the same percentage of sales increase.

Price drives Volume

Especially in tough economic times, shoppers can seldom resist stocking up on quality brands that slash the price to sustain volume sales. But every marketer knows that price discounting simply undermines the equity that is so costly to build in the first place Cutting price is no way to remain competitive over the long term.

Engagement drives brand sales

Brands that actually engage shoppers, experientially or emotionally, tend to turn shoppers into buyers. Engagement can take many forms, from creating a powerful brand experience with shoppers outside the store, having brand ambassadors interacting with them in-store, to demos and sampling, to cause related brand associations (sustainability is a favorite these days) that resonate with shoppers when its time to buy.

Retail: Personalised Services to Generate Customer Confidence

In recent years, the Internet and e-commerce have revolutionized the retail industry, in the same way, for example, as the  appearance of supermarkets. Beyond ease of purchase and the ability to consult the opinion of other consumers, e-commerce has overwhelmingly changed the way in which information about a customer’s journey to purchase is captured. Today, it is also captured on a far more individual basis. For example, e-commerce enables you to know, with relative ease, what a particular customer is looking for, how they reached the site, what they buy, the associated products they have purchased previously, and even what purchases they abandoned. Reconstructing the customer’s journey was extremely difficult to achieve when the sole purchasing channel was the physical store and the only traceable element was the purchase itself. At best, the customer was only identified at the checkout, which, for example, ruled out the prospect of providing them personalized recommendations.

appearance of supermarkets. Beyond ease of purchase and the ability to consult the opinion of other consumers, e-commerce has overwhelmingly changed the way in which information about a customer’s journey to purchase is captured. Today, it is also captured on a far more individual basis. For example, e-commerce enables you to know, with relative ease, what a particular customer is looking for, how they reached the site, what they buy, the associated products they have purchased previously, and even what purchases they abandoned. Reconstructing the customer’s journey was extremely difficult to achieve when the sole purchasing channel was the physical store and the only traceable element was the purchase itself. At best, the customer was only identified at the checkout, which, for example, ruled out the prospect of providing them personalized recommendations.

Thanks to a better understanding of the customer’s journey to purchase, e-commerce has opened up the possibility of not only gaining a better understanding of customer behaviour, but also the ability to react in real time based on this knowledge. Due to the success of such programmes, distributors have considered applying these concepts across all sales channels – stores, call centres, etc. This is the dual challenge facing most retailers today: to fully understand the customer’s journey across different sales channels (multi-channel or omni-channel), while benefiting from greater accuracy, including in the case of physical retail outlets.

This is not as easy as it seems. Depending on the channel chosen by the customer, the knowledge obtained by the seller is not the same: as we know, whilst at the checkout, the customer will only be recognized if they own a loyalty card or have previously visited the store. But, in the latter case, it will be extremely complex to make the link to past purchases. Similarly, a website may enable the collection of data on the intention to buy, but it is extremely difficult to correlate these events with the purchasing transactions if they are not made online and in the same session. The stakes are high, given that 78% of consumers now do their research online prior to making a purchase[1] (the famous Web-to-store or ROPO).

One solution is to integrate sensors into the various elements that make up a customer’s purchasing journey, then analyse and cross reference this big data to extract concrete information from it. For example, we have noticed that Internet users often visit commercial websites during the week in order to prepare for making a purchase on a Saturday. If, for example, it has a self-service wi-fi facility linked to a mobile app enabling it to personalize the customer’s journey, the store can follow this journey right up to the actual purchase, or even influence it by proposing a good deal at just the right moment.

Some of our customers are already largely engaged in this process, which is done in a gradual manner. It all usually begins with a very detailed analysis of the customer’s online journey, to collect information on intention, cross reference it at an aggregated level with the actual purchases, at the catchment-area level, for example, to determine correlations and refine the segmentations. Then, this information is cross referenced for a second time with the transactional data from the physical stores and the website, which enables us to map the customer’s journey from the intention to buy to the purchase or even beyond, and across different channels. Thirdly, it’s a matter of developing a recommendation system in real time throughout the customer’s journey that yields a dual benefit: increased sales and greater loyalty.

The main challenge facing distributors in the future actually lies in the value-added services that they may or may not be able to provide to their customers, to accompany their products or services. Consumers have learned to be wary of digital technology. For example, they create specific email addresses to get the offer they need without revealing their true identity in order to prevent further contact. More than ever, they will only be inclined to share information on their intentions and their profiles if their trust has been gained and they perceive some benefit.

How do you create this trust? Via value-added services: when consumers see that their interests are being considered, they do not feel constrained or trapped by a commercial logic that is beyond them. Let us imagine that, on the basis of till receipts or a basket that is in the process of being filled, a retailer can guide the choice of products based on personal criteria, excluding, for example, those that contain peanut oil, which I must avoid as my son has just been declared highly allergic to it. I am aware that my journey is being tracked by the retailer, but I understand its uses and I derive some benefit from it. Amazon, with its “1-Click” ordering, has shown the way. In other sectors, such as the taxi industry, newcomers have gone even further, revolutionizing the customer’s journey by utilizing digital technology, from searching for a service to payment through a range of innovative services that make the customer’s life easier, such as the automated capture of expense forms.

In a world in which advertising and tracking are increasingly present, data analysis that is carried out with the sole aim of commercial transformation is ultimately doomed to failure, as it is based on an imbalance between the benefits offered to the customer and those gained by the supplier[2]. Until now, personalisation in retail has had a tendency to limit itself to marketing and measurement based on conversion rates, except for distributors, which have increasingly relied on customer loyalty. Multi-channel is not the invention of the distributors but a reaction to consumers’ wishes. Think about it, even Amazon, Internet pure player par excellence, is going to start opening physical stores. Why? Because it has fully understood that a key element was missing in its bid to become better acquainted with its customers’ journey, while responding more effectively to their wishes.